Recently, the IPO of domestic brand leader Tianhai Electronics on the Shenzhen Stock Exchange was accepted. 83% of its revenue comes from the automotive wiring harness business, and its wire harness revenue exceeded 10.1 billion yuan in 2024, confirming the strong growth of the industry. Under the trend of high voltage and intelligence in new energy vehicles, traditional low-voltage wiring harnesses can no longer meet the demand. High voltage wiring harnesses with a withstand voltage of over 1500V and high-speed wiring harnesses supporting 10Gbps data transmission have become the new favorites, driving the industry market size to leap towards 150 billion yuan. Xiaoxing will now take you to understand the situation of the automotive wiring harness industry.

The main characteristics of the automotive wiring harness industry

The main characteristics of the automotive wiring harness industry include: high-voltage wiring harnesses have become the core driving force for market growth, and thanks to the rapid development of the new energy vehicle market, their demand is significantly higher than that of traditional fuel vehicles, driving technological upgrades. The industry is highly concentrated and has high technological barriers. The global market CR3 reaches 71%, and the leading position of top enterprises is stable, forming a high entry threshold. The supplier qualification barrier is high, and automobile manufacturers have strict and long screening criteria for wire harness suppliers, which constitutes an important moat. In addition, automotive wiring harness products have customized requirements, and different vehicle manufacturers and models need to match different design schemes and quality standards.

(Image source: Row by Row Database)

Classification of the automotive wiring harness industry

Automotive wiring harnesses can be divided into power lines and signal lines according to their functions. The former is used to transmit current, while the latter is used to transmit electrical signals; According to their purposes, they are divided into front cabin wiring harness, engine wiring harness, instrument wiring harness, indoor wiring harness, etc. Due to the higher degree of electrification, new energy vehicles require more complex wiring harnesses, and their single vehicle value far exceeds that of traditional fuel vehicles.

(Image source: Row by Row Database)

(Image source: Row by Row Database)

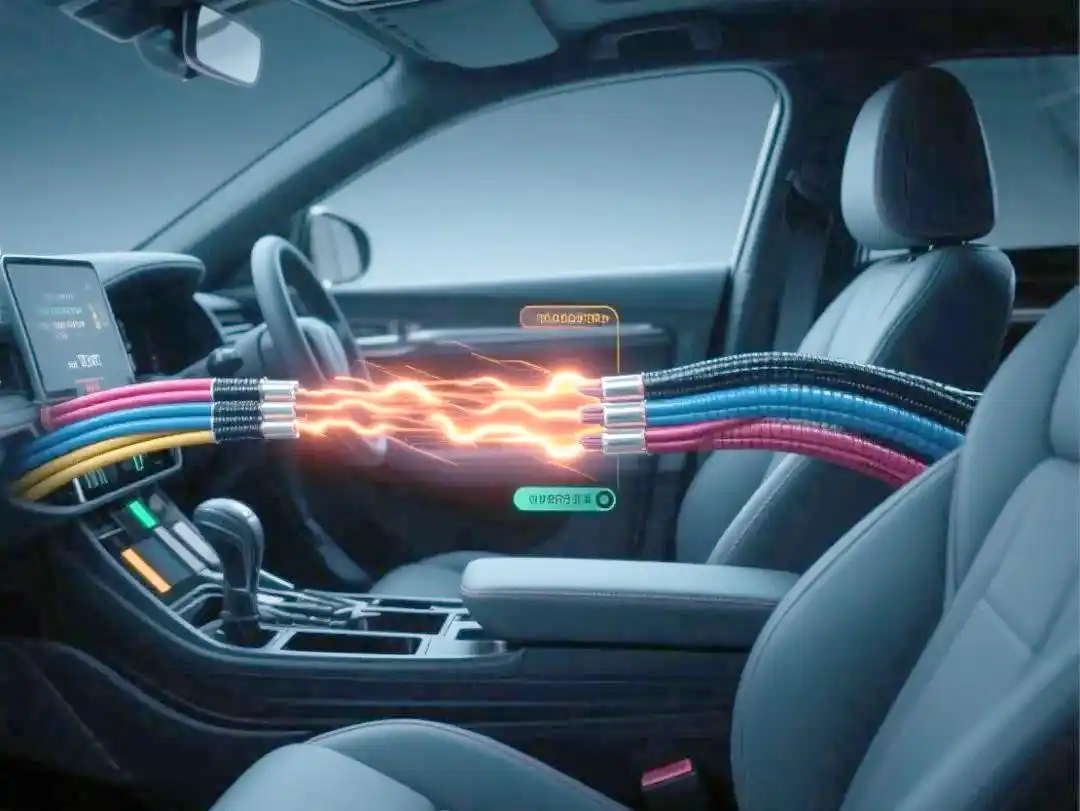

Automotive wiring harnesses are the blood vessels and nerves of automotive electronic systems

As the "blood vessels" and "nerves" of automotive electronic systems, automotive wiring harnesses have ushered in a golden period of growth on both the supply and demand sides under the trend of electric intelligence. On the demand side, the consumer market's demand for advanced features such as active safety systems and comfortable driving functions has driven the widespread application of electronic components, and the implementation of these functions relies on the transmission of signals, data, and electrical energy through wiring harnesses. On the supply side, the trend of "new four modernizations" (electrification, networking, intelligence, and sharing) has driven the increase of automotive electronic and electrical functions and architecture iteration, providing broad development space for the wire harness industry.

(Image source: Row by Row Database)

The current size and growth trend of the global automotive wiring harness market

In terms of market size, the global automotive wiring harness market is expected to reach approximately $60 billion in 2023 and is projected to increase to $100.898 billion by 2030, with a compound annual growth rate (CAGR) of 7.97%. Although the growth rate has fluctuated in different years, it has remained stable overall. For example, the growth rate reached its peak of 8% in 2021, fell back to 4% in 2022, and then gradually rebounded. It is expected to remain around 4% in 2025.

(Image source: Row by Row Database)

Data source: Xingxingcha | Industry Research Database www.hanghangcha.com

Key links and major participants in the upstream and downstream of the automotive wiring harness industry chain

The automotive wiring harness industry chain covers upstream raw material supply, midstream wiring harness manufacturing, and downstream automotive industry applications. The upstream mainly includes suppliers of basic raw materials such as copper, rubber, and plastic materials. The main participants include overseas enterprises such as Treca and Aike Group, as well as domestic enterprises such as Robenyi and Beijing Volkswagen. The midstream involves the manufacturing of wire harnesses, which are divided into two major fields: high-voltage wire harnesses and low-voltage wire harnesses. Internationally renowned enterprises include LEONI, APTIV, YAZAKI, etc., while domestic enterprises include KSHG, Tianhai Electronics, etc. Downstream customers include traditional car companies (such as GAC Group and SAIC Group) and new energy vehicle companies (such as NIO, Tesla, BYD), who are the end users of wiring harness products.

(Image source: Row by Row Database)

The competitive landscape of the automotive wiring harness industry

In terms of competitive landscape, the automotive wiring harness market in 2025 shows a clear trend of concentration, with leading companies occupying a dominant position. Yazaki ranks first with a market share of 30%, Sumitomo Electric and Anbofu occupy 24% and 17% respectively, and CR3 reaches as high as 71%. Other companies such as Lenny, Sama, and Lier also have a place, but their market share is relatively small. At the same time, the proportion of the "other" category cannot be ignored, indicating that there is still a certain degree of diversification in the market.

(Image source: Row by Row Database)

The business model of the automotive wiring harness industry

In terms of business model, the industry is shifting from traditional mass production to flexible and customized production. To meet the customized needs of different vehicle models, enterprises adopt modular design and manufacturing, provide solutions with higher integration, and strengthen collaborative development capabilities with OEMs to shorten the introduction cycle of new products and improve efficiency.

There are significant differences in the average single vehicle value of automotive wiring harnesses among different types of vehicles. Specifically, the average single vehicle value of automotive wiring harnesses for low-end traditional passenger cars is about 2500 yuan, while for mid-range traditional passenger cars it increases to about 3500 yuan, and for high-end traditional passenger cars it further increases to about 4500 yuan. The average single vehicle value of automotive wiring harnesses for new energy vehicles is the highest, reaching about 5000 yuan. This indicates that with the improvement of vehicle grades and technological innovations, especially the development of new energy vehicles, the demand and value of automotive wiring harnesses are gradually increasing, reflecting the market's emphasis on high-quality and high-performance automotive components and the trend of demand growth.

(Image source: Row by Row Database)

The direction of technological innovation in the automotive wiring harness industry

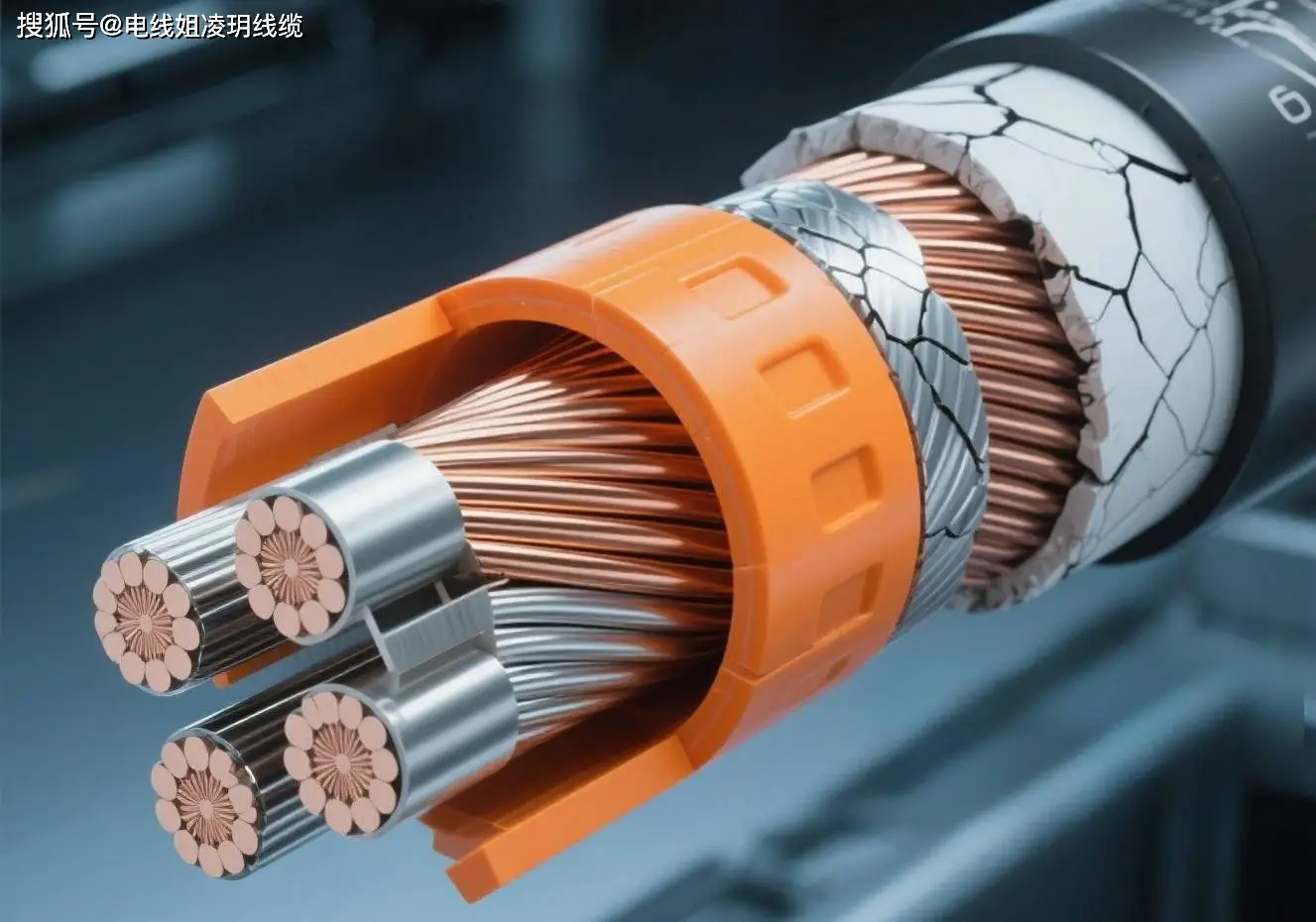

In terms of technological innovation, high-voltage wiring harnesses have become the main driving force for industry development, especially in the field of new energy vehicles. To meet the demand for high-voltage energy transmission, wire harnesses need to have better insulation performance, heat resistance, and mechanical strength. At the same time, lightweight research has received attention, as new composite materials or optimized structural designs can reduce weight while ensuring safety. In addition, with the acceleration of digital transformation, big data analysis and IoT technology are widely used for predictive maintenance and remote monitoring, helping enterprises improve production efficiency and service levels.

In short, the automotive wiring harness industry is in a stage of rapid development and technological innovation. Faced with fierce market competition, only enterprises that continue to innovate and improve their service systems can maintain a leading position.

![[list:title ] Factory Direct 6A Fast Charging 2-in-1 Type-C Data Cable TPE Jacket Super Fast Charging Function for](/runtime/image/mw200_mh_1754970367606571.png) Factory Direct 6A Fast Charging 2-in-1 Type-C Data Cable TPE Jacket Super Fast Charging Function for

Factory Direct 6A Fast Charging 2-in-1 Type-C Data Cable TPE Jacket Super Fast Charging Function for![[list:title ] 3A/5A Fast Charging Intelligent Power-off Data Cable Type-C USB with Braided Jacket 1M Length for Mo](/runtime/image/mw200_mh_1754970445122718.png) 3A/5A Fast Charging Intelligent Power-off Data Cable Type-C USB with Braided Jacket 1M Length for Mo

3A/5A Fast Charging Intelligent Power-off Data Cable Type-C USB with Braided Jacket 1M Length for Mo![[list:title ] Type-C Cable 1M Fast Charging Flexible Braided for Mobile Phone Power Bank with Gradient Shell Invis](/runtime/image/mw200_mh_1754970599124240.png) Type-C Cable 1M Fast Charging Flexible Braided for Mobile Phone Power Bank with Gradient Shell Invis

Type-C Cable 1M Fast Charging Flexible Braided for Mobile Phone Power Bank with Gradient Shell Invis![[list:title ] Factory Direct PD Type C-C Fast Charging Cable Pure Copper Braided Nylon Aluminum Alloy Jacket for M](/runtime/image/mw200_mh_1754970685778571.jpg) Factory Direct PD Type C-C Fast Charging Cable Pure Copper Braided Nylon Aluminum Alloy Jacket for M

Factory Direct PD Type C-C Fast Charging Cable Pure Copper Braided Nylon Aluminum Alloy Jacket for M![[list:title ] RGB Luminous Nylon Braided Fast Charging Side Lighting Seven-Color Type C Data Cable USB Compatible](/runtime/image/mw200_mh_1754970772864871.jpg) RGB Luminous Nylon Braided Fast Charging Side Lighting Seven-Color Type C Data Cable USB Compatible

RGB Luminous Nylon Braided Fast Charging Side Lighting Seven-Color Type C Data Cable USB Compatible![[list:title ] Factory Braided Shield USB Fast Charging Cable Type-C Micro Connectors for Mobile Phones Computers P](/runtime/image/mw200_mh_1754970914446714.jpg) Factory Braided Shield USB Fast Charging Cable Type-C Micro Connectors for Mobile Phones Computers P

Factory Braided Shield USB Fast Charging Cable Type-C Micro Connectors for Mobile Phones Computers P![[list:title ] Customized 1M 3A Fast Charging 4-in-1 Flat Metal Case USB Android Power Bank Type-C Connector Nylon](/runtime/image/mw200_mh_1754971132172086.jpg) Customized 1M 3A Fast Charging 4-in-1 Flat Metal Case USB Android Power Bank Type-C Connector Nylon

Customized 1M 3A Fast Charging 4-in-1 Flat Metal Case USB Android Power Bank Type-C Connector Nylon![[list:title ] 1m Aluminum Alloy Transparent Connector Type-C Data Fast Charging Cable 2-in-1 Nylon Jacket with Foi](/runtime/image/mw200_mh_1754971206813424.jpg) 1m Aluminum Alloy Transparent Connector Type-C Data Fast Charging Cable 2-in-1 Nylon Jacket with Foi

1m Aluminum Alloy Transparent Connector Type-C Data Fast Charging Cable 2-in-1 Nylon Jacket with Foi![[list:title ] USB 2.0 5-Pin SH Type Male Cable 1m Fast Charging 3A for Mobile Phones Power Banks Cameras Computers](/runtime/image/mw200_mh_1751290248528158.png) USB 2.0 5-Pin SH Type Male Cable 1m Fast Charging 3A for Mobile Phones Power Banks Cameras Computers

USB 2.0 5-Pin SH Type Male Cable 1m Fast Charging 3A for Mobile Phones Power Banks Cameras Computers![[list:title ] Universal PVC Insulated Copper Conductor Harness Wire Electronic Play Cable Plug for Gaming Machine](/runtime/image/mw200_mh_1751290043732325.png) Universal PVC Insulated Copper Conductor Harness Wire Electronic Play Cable Plug for Gaming Machine

Universal PVC Insulated Copper Conductor Harness Wire Electronic Play Cable Plug for Gaming Machine![[list:title ] Premium Custom PVC Insulated Auto Electrical Wiring Harness for Cars & Motorcycles Specific Appl](/runtime/image/mw200_mh_1751289911932558.png) Premium Custom PVC Insulated Auto Electrical Wiring Harness for Cars & Motorcycles Specific Appl

Premium Custom PVC Insulated Auto Electrical Wiring Harness for Cars & Motorcycles Specific Appl![[list:title ] OEM ODM Custom Motorcycle & Automobile PVC Insulated Electrical Wiring Harness Copper Custom Wir](/runtime/image/mw200_mh_1751289859503493.png) OEM ODM Custom Motorcycle & Automobile PVC Insulated Electrical Wiring Harness Copper Custom Wir

OEM ODM Custom Motorcycle & Automobile PVC Insulated Electrical Wiring Harness Copper Custom Wir![[list:title ] Manufacturer Customized PVC Insulated Copper Conductor Electrical Wire Harness for Electronic Applic](/runtime/image/mw200_mh_1751289819362910.png) Manufacturer Customized PVC Insulated Copper Conductor Electrical Wire Harness for Electronic Applic

Manufacturer Customized PVC Insulated Copper Conductor Electrical Wire Harness for Electronic Applic![[list:title ] Hot Sale 10PIN Female Flat Touch Screen Ribbon Cable RS232 Serial D-Sub DB9 9PIN Port IDC Male PVC C](/runtime/image/mw200_mh_1751289746509799.png) Hot Sale 10PIN Female Flat Touch Screen Ribbon Cable RS232 Serial D-Sub DB9 9PIN Port IDC Male PVC C

Hot Sale 10PIN Female Flat Touch Screen Ribbon Cable RS232 Serial D-Sub DB9 9PIN Port IDC Male PVC C![[list:title ] High Quality ZX330-5G Excavator Safety Relay 1825530391 24V Starter Essential Construction Machinery](/runtime/image/mw200_mh_1751289703107392.png) High Quality ZX330-5G Excavator Safety Relay 1825530391 24V Starter Essential Construction Machinery

High Quality ZX330-5G Excavator Safety Relay 1825530391 24V Starter Essential Construction Machinery![[list:title ] High Quality New Condition AUTO PARTS Wiring Harness 4HG1 NPR Cable Hand Brake Truck Wholesales PVC](/runtime/image/mw200_mh_1751289653205137.png) High Quality New Condition AUTO PARTS Wiring Harness 4HG1 NPR Cable Hand Brake Truck Wholesales PVC

High Quality New Condition AUTO PARTS Wiring Harness 4HG1 NPR Cable Hand Brake Truck Wholesales PVC![[list:title ] XHB High-Temperature Resistant Wiring Harness Locking Terminal Cable 200mm Length 12504H00-5P Connec](/runtime/image/mw200_mh_1751293406317163.png) XHB High-Temperature Resistant Wiring Harness Locking Terminal Cable 200mm Length 12504H00-5P Connec

XHB High-Temperature Resistant Wiring Harness Locking Terminal Cable 200mm Length 12504H00-5P Connec![[list:title ] XH2.54 JST Silicone Battery Wires Cable Connector 20cm Black Electronic Application 220mm Cable OC3](/runtime/image/mw200_mh_1751293362444100.png) XH2.54 JST Silicone Battery Wires Cable Connector 20cm Black Electronic Application 220mm Cable OC3

XH2.54 JST Silicone Battery Wires Cable Connector 20cm Black Electronic Application 220mm Cable OC3![[list:title ] XH2.54 JST 20cm Black Silicon Gel Wires Connector 380mm DC Ribbon Cable Wiring Harness for Electroni](/runtime/image/mw200_mh_1751293307595602.png) XH2.54 JST 20cm Black Silicon Gel Wires Connector 380mm DC Ribbon Cable Wiring Harness for Electroni

XH2.54 JST 20cm Black Silicon Gel Wires Connector 380mm DC Ribbon Cable Wiring Harness for Electroni![[list:title ] Wire Harness UL2468#24 White Blue 4P Ribbon Cable, One End HA-4P With Buckle, Other End HA-4P Withou](/runtime/image/mw200_mh_1751293254961173.png) Wire Harness UL2468#24 White Blue 4P Ribbon Cable, One End HA-4P With Buckle, Other End HA-4P Withou

Wire Harness UL2468#24 White Blue 4P Ribbon Cable, One End HA-4P With Buckle, Other End HA-4P Withou![[list:title ] UL-Certified Industrial Automation Servo Motor Cable 500mm Length Brown Blue PVC_PE Wires HA-6P SM-2](/runtime/image/mw200_mh_1751293224859016.png) UL-Certified Industrial Automation Servo Motor Cable 500mm Length Brown Blue PVC_PE Wires HA-6P SM-2

UL-Certified Industrial Automation Servo Motor Cable 500mm Length Brown Blue PVC_PE Wires HA-6P SM-2![[list:title ] PVC Plasticlogic Flexible Household Appliance Wiring Harness Tinned Copper Conductor One End Semi-St](/runtime/image/mw200_mh_1751293191631742.png) PVC Plasticlogic Flexible Household Appliance Wiring Harness Tinned Copper Conductor One End Semi-St

PVC Plasticlogic Flexible Household Appliance Wiring Harness Tinned Copper Conductor One End Semi-St![[list:title ] PVC Insulated Copper Conductor Wiring Harness Connector for Electric Cars for Automobile Use](/runtime/image/mw200_mh_1751293135247963.png) PVC Insulated Copper Conductor Wiring Harness Connector for Electric Cars for Automobile Use

PVC Insulated Copper Conductor Wiring Harness Connector for Electric Cars for Automobile Use![[list:title ] OEM UL2468 UL2651 Customized 5pin White Wiring Harness 1.27mm 2.0mm 2.54mm Electrical Wire JST XH Co](/runtime/image/mw200_mh_1751293103170614.png) OEM UL2468 UL2651 Customized 5pin White Wiring Harness 1.27mm 2.0mm 2.54mm Electrical Wire JST XH Co

OEM UL2468 UL2651 Customized 5pin White Wiring Harness 1.27mm 2.0mm 2.54mm Electrical Wire JST XH Co![[list:title ] Premium IP68 Waterproof Circular Connectors SP13 SP21 LED Cable Connector 2-7p Number Cores Wiring H](/runtime/image/mw200_mh_1751287652901338.png) Premium IP68 Waterproof Circular Connectors SP13 SP21 LED Cable Connector 2-7p Number Cores Wiring H

Premium IP68 Waterproof Circular Connectors SP13 SP21 LED Cable Connector 2-7p Number Cores Wiring H![[list:title ] Pole EV Battery Connector 8mm Copper Contact Material with 50A Rated Current Straight Orientation](/runtime/image/mw200_mh_1751287559833642.png) Pole EV Battery Connector 8mm Copper Contact Material with 50A Rated Current Straight Orientation

Pole EV Battery Connector 8mm Copper Contact Material with 50A Rated Current Straight Orientation![[list:title ] New Energy Inverter Battery Connectors 3P 120A Rated Copper Contacts EV Conversions with Straight An](/runtime/image/mw200_mh_1751287256545420.png) New Energy Inverter Battery Connectors 3P 120A Rated Copper Contacts EV Conversions with Straight An

New Energy Inverter Battery Connectors 3P 120A Rated Copper Contacts EV Conversions with Straight An![[list:title ] M12 Black Round Socket 2.5m Cable Waterproof 8-Pin Connector Enhanced IP67_IP68 Overmolded TPU Screw](/runtime/image/mw200_mh_1751287205474322.png) M12 Black Round Socket 2.5m Cable Waterproof 8-Pin Connector Enhanced IP67_IP68 Overmolded TPU Screw

M12 Black Round Socket 2.5m Cable Waterproof 8-Pin Connector Enhanced IP67_IP68 Overmolded TPU Screw![[list:title ] M12 3-Pin Connector Cable 1000mm Fast Electric Car Charging Station Single Output Indoor_Outdoor 8KG](/runtime/image/mw200_mh_1751287108943181.png) M12 3-Pin Connector Cable 1000mm Fast Electric Car Charging Station Single Output Indoor_Outdoor 8KG

M12 3-Pin Connector Cable 1000mm Fast Electric Car Charging Station Single Output Indoor_Outdoor 8KG![[list:title ] JL15EDGKNHM-35008B01 Black 2_8P Pitch 3.5mm 2 Row 8 Pin Terminal Blocks Position 2 for Wiring Harnes](/runtime/image/mw200_mh_1751287072360672.png) JL15EDGKNHM-35008B01 Black 2_8P Pitch 3.5mm 2 Row 8 Pin Terminal Blocks Position 2 for Wiring Harnes

JL15EDGKNHM-35008B01 Black 2_8P Pitch 3.5mm 2 Row 8 Pin Terminal Blocks Position 2 for Wiring Harnes![[list:title ] HVIL 2-Pin New Energy Vehicle Connector Socket 125A Capacity 25mm2 Cable Product Category Connectors](/runtime/image/mw200_mh_1751287006387917.png) HVIL 2-Pin New Energy Vehicle Connector Socket 125A Capacity 25mm2 Cable Product Category Connectors

HVIL 2-Pin New Energy Vehicle Connector Socket 125A Capacity 25mm2 Cable Product Category Connectors![[list:title ] High-Pressure PVC Insulated Wiring Harness for Automobiles Flexible Grease and Oil Hose H20PDU Coppe](/runtime/image/mw200_mh_1751286944271896.png) High-Pressure PVC Insulated Wiring Harness for Automobiles Flexible Grease and Oil Hose H20PDU Coppe

High-Pressure PVC Insulated Wiring Harness for Automobiles Flexible Grease and Oil Hose H20PDU Coppe