Market explosion and structural transformation: New energy drives scale leap

The market size of China's automotive wiring harness is expected to reach 107.03 billion yuan in 2023, a year-on-year increase of 31.39%, and is expected to surpass the 120 billion yuan mark by 2025. Among them, the proportion of new energy vehicle wiring harnesses has soared from 4.8% in 2019 to 62.5% in 2025, with a market size of about 75 billion yuan, becoming the core driving force for industry growth.

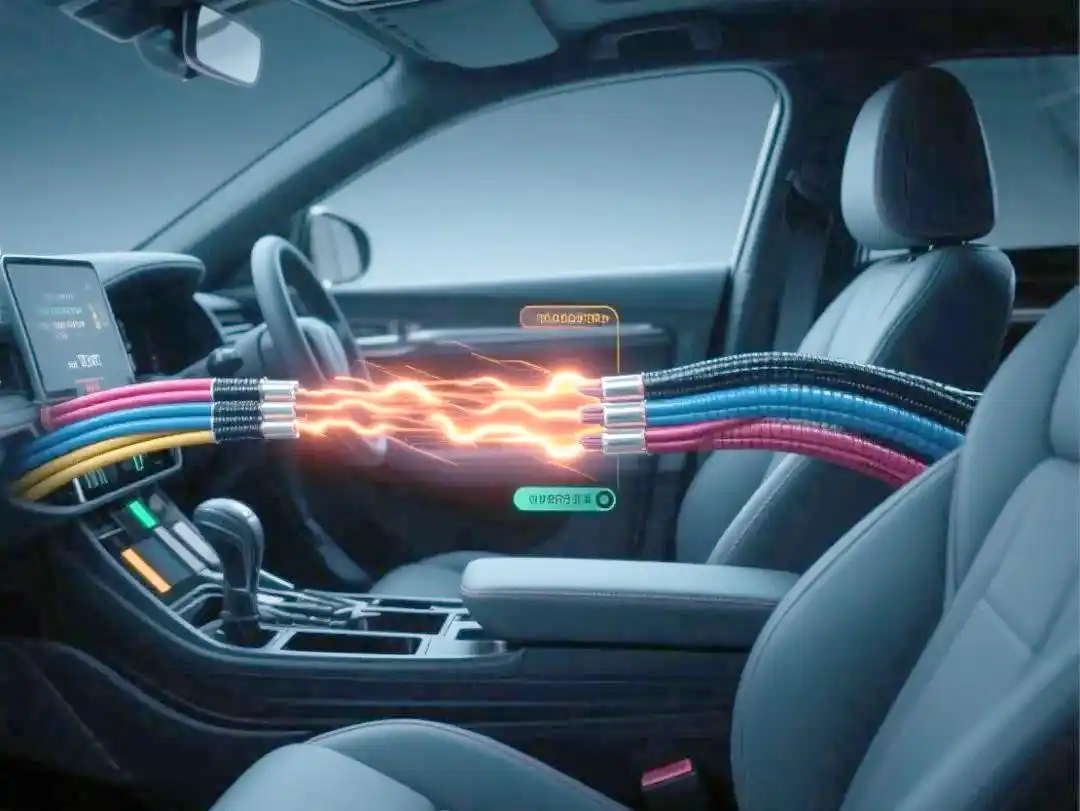

The rise of new energy vehicles has brought significant growth to the wiring harness market. New energy vehicles have added high-voltage wiring harness systems, such as fast charging wiring harnesses and battery pack wiring harnesses, which have increased the value of a single vehicle to over 5000 yuan, an increase of over 60% compared to traditional fuel vehicles (with a value of about 3000 yuan per vehicle).

High voltage wiring harness leading technology upgrade

With the popularization of 800V high-voltage platforms, the performance of high-voltage wiring harnesses has achieved a qualitative leap. Its voltage resistance level has been increased from 600V to over 1500V, and the global market size is expected to reach $18 billion by 2025, with the Chinese market accounting for about 45%.

However, technological upgrades have also brought many challenges. Silicone insulation material, three-layer electromagnetic shielding structure (copper weaving+aluminum foil+absorbing layer), and liquid cooling heat dissipation design have become key breakthrough points. For example, the 1000V liquid cooled wire harness jointly developed by CATL and Anbofu showcases the industry's cutting-edge exploration in high-voltage wire harness technology.

The three main axes of technological revolution: high voltage, lightweight, and intelligence

High voltage and high-frequency transmission technology

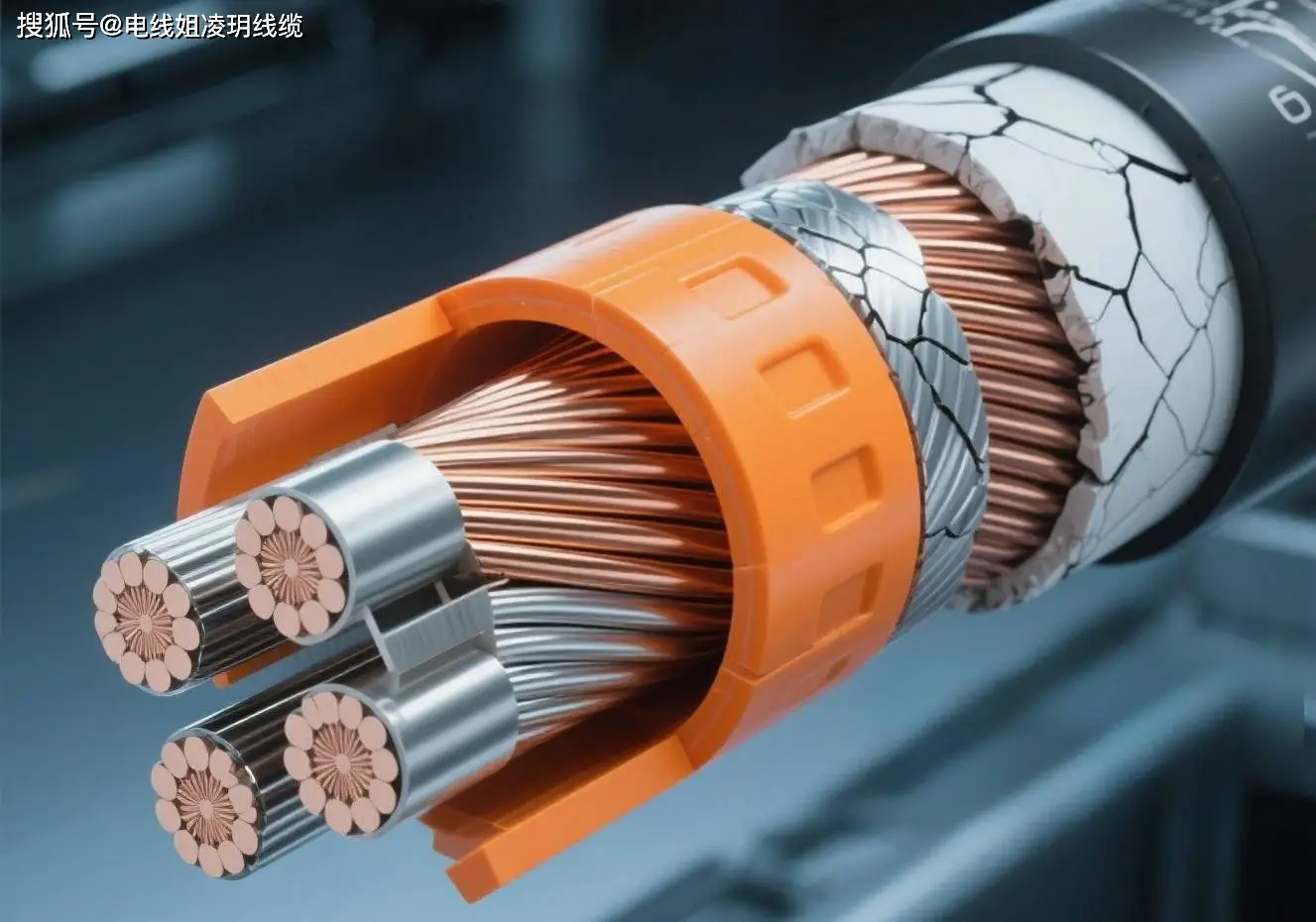

In terms of energy transmission, high-voltage wiring harnesses need to support currents above 400A, with wire cross-sectional areas increasing from 35mm ² to 70mm ². The connector coating has also shifted from gold plating to silver nickel alloy to reduce resistance. In terms of signal transmission, L3+autonomous driving technology has given birth to in vehicle Ethernet harnesses with a bandwidth of up to 10Gbps, gradually replacing traditional CAN buses. For example, after adopting an Ethernet backbone, the ideal L9 reduced the length of the wiring harness by 40% and the latency by 60%.

Breakthroughs in Lightweight Materials and Processes

Replacing copper with aluminum is an important measure for lightweighting. The conductivity of aluminum wire can reach 97% of copper, reducing weight by 30% and cost by 40%. Huguang Corporation has solved the problem of aluminum oxidation through nano coating technology, and it is expected that the application proportion of aluminum wires will reach 22% by 2025. In addition, the carbon fiber composite sheath and thin-walled insulation technology (with a wall thickness of only 0.1mm) can reduce the weight of the wiring harness by 60% and increase the vehicle's range by 5% -10%.

Intelligent Manufacturing and Modular Design

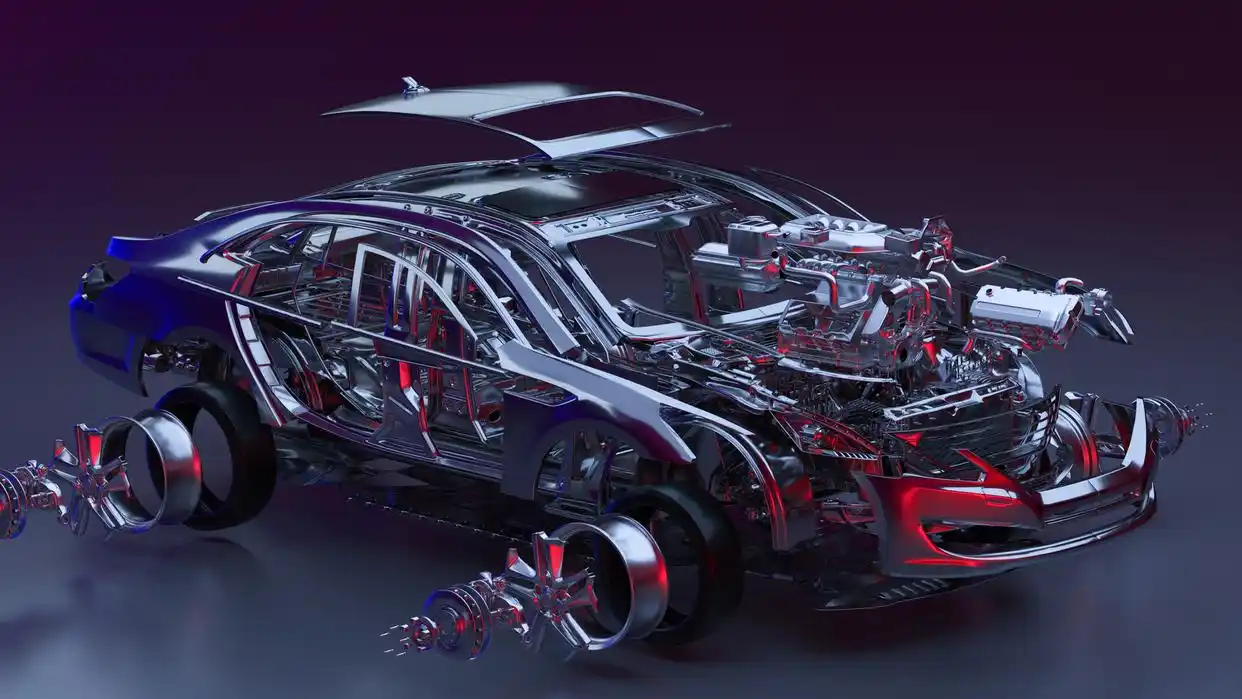

In terms of intelligent manufacturing, the application of AI quality inspection and machine vision technology has reduced the defect rate of wire harnesses from 0.5% to 0.1%. It is expected that by 2025, the automation rate of domestic factories will reach 75%, and labor costs will be reduced by 40%. In terms of modular design, BYD e-platform 3.0 reduces the number of connector types from 120 to 30, increasing assembly efficiency by 25%; The total length of Tesla Cybertruck's wiring harness is only 100 meters, which is 77% less than traditional models.

Restructuring of the competitive landscape: domestic substitution accelerates the breaking of foreign monopoly

In the global market, foreign-funded enterprises such as Yazaki, Sumitomo, and Anbofu have long dominated, with a CR3 market share of up to 71%. However, the market share of domestic Chinese enterprises has rapidly increased from 3% to 28%, demonstrating a strong upward trend.

Domestic enterprises are gradually breaking the monopoly of foreign investment with the advantages of 40% lower costs and 30% shorter response cycles. For example, Huguang Corporation and Tianhai Electric have entered the supply chains of Tesla and BYD, and their high-voltage wire harnesses have also exceeded 1000V in voltage resistance.

The preference of new energy car companies such as NIO and Ideal for local suppliers has led to a reduction in the customized development cycle from 12 months to 8 months. Local enterprises rely on regional production capacity layout (such as the Yangtze River Delta industrial cluster covering 50% of demand) to ensure delivery resilience.

Industrial Chain Challenges and Collaborative Innovation

Upstream raw material fluctuations and low-carbon transformation

The fluctuation of copper prices has led to a 3-5 percentage point decline in the gross profit margin of enterprises (copper accounts for 65% -80% of costs). Enterprises alleviate cost pressures through futures hedging and aluminum substitution. At the same time, the EU's "New Battery Regulation" requires a wire harness recycling rate of over 95%, promoting the use of bio based materials such as BASF Ultramid ® The application of Bio has reduced carbon footprint by 60%.

Downstream car companies are forcing technological upgrades

The concentration of vehicle manufacturers is relatively high (with the top five customers accounting for over 70%), and they have strong bargaining power. For example, the gross profit margin of Anbofu supplying Tesla is only 15%, lower than the industry average (20%). This forces companies to reduce costs through automated production.

Future Trends

Technology Fusion Acceleration

In terms of high-voltage supercharging ecology, 4C fast charging technology can achieve a 10 minute range of 400 kilometers, and liquid cooled wiring harnesses will become standard. In terms of wireless wired hybrid, the BMW iX uses UWB technology to reduce the number of door wiring harnesses by 12, and it is expected that the proportion of hybrid architecture will exceed 80% by 2025.

Global layout and standard output

Local enterprises are transforming from "parts suppliers" to "technical standard setters". For example, CATL's CTP technology was licensed to Ford, bypassing the restrictions of the US IRA Act. The regional layout of production capacity is also accelerating, such as establishing production bases in Mexico to serve the North American market (reducing tariffs by 15%), and achieving an automation rate of 85% in Eastern European factories to cope with EU carbon tariffs.

Sustainable development becomes a core indicator

In terms of lightweight goals, it is expected that by 2035, the weight of pure electric vehicles will decrease by 35%, and the proportion of wiring harnesses will be reduced to below 3%. In terms of closed-loop recycling system, Ningde Times Hubei Base can process 120000 tons of batteries annually, with a copper and aluminum reuse rate of over 95%.

conclusion

The Chinese automotive wiring harness industry is undergoing a qualitative change from a "follower" to a "rule maker". On the technical side, reshape product definition through high voltage, lightweight, and intelligence; At the end of the industrial chain, efficiency can be reconstructed through automation and modularization; On the competitive side, breaking the 70% foreign monopoly through domestic substitution. In the next five years, if local enterprises can continue to break through in the three major fields of supercharging ecology, material recycling, and international standards, they are expected to seize 25% of the global market of 18 billion US dollars, truly achieving the industrial transition from "nerve vessels" to "intelligent centers".

![[list:title ] Factory Direct 6A Fast Charging 2-in-1 Type-C Data Cable TPE Jacket Super Fast Charging Function for](/runtime/image/mw200_mh_1754970367606571.png) Factory Direct 6A Fast Charging 2-in-1 Type-C Data Cable TPE Jacket Super Fast Charging Function for

Factory Direct 6A Fast Charging 2-in-1 Type-C Data Cable TPE Jacket Super Fast Charging Function for![[list:title ] 3A/5A Fast Charging Intelligent Power-off Data Cable Type-C USB with Braided Jacket 1M Length for Mo](/runtime/image/mw200_mh_1754970445122718.png) 3A/5A Fast Charging Intelligent Power-off Data Cable Type-C USB with Braided Jacket 1M Length for Mo

3A/5A Fast Charging Intelligent Power-off Data Cable Type-C USB with Braided Jacket 1M Length for Mo![[list:title ] Type-C Cable 1M Fast Charging Flexible Braided for Mobile Phone Power Bank with Gradient Shell Invis](/runtime/image/mw200_mh_1754970599124240.png) Type-C Cable 1M Fast Charging Flexible Braided for Mobile Phone Power Bank with Gradient Shell Invis

Type-C Cable 1M Fast Charging Flexible Braided for Mobile Phone Power Bank with Gradient Shell Invis![[list:title ] Factory Direct PD Type C-C Fast Charging Cable Pure Copper Braided Nylon Aluminum Alloy Jacket for M](/runtime/image/mw200_mh_1754970685778571.jpg) Factory Direct PD Type C-C Fast Charging Cable Pure Copper Braided Nylon Aluminum Alloy Jacket for M

Factory Direct PD Type C-C Fast Charging Cable Pure Copper Braided Nylon Aluminum Alloy Jacket for M![[list:title ] RGB Luminous Nylon Braided Fast Charging Side Lighting Seven-Color Type C Data Cable USB Compatible](/runtime/image/mw200_mh_1754970772864871.jpg) RGB Luminous Nylon Braided Fast Charging Side Lighting Seven-Color Type C Data Cable USB Compatible

RGB Luminous Nylon Braided Fast Charging Side Lighting Seven-Color Type C Data Cable USB Compatible![[list:title ] Factory Braided Shield USB Fast Charging Cable Type-C Micro Connectors for Mobile Phones Computers P](/runtime/image/mw200_mh_1754970914446714.jpg) Factory Braided Shield USB Fast Charging Cable Type-C Micro Connectors for Mobile Phones Computers P

Factory Braided Shield USB Fast Charging Cable Type-C Micro Connectors for Mobile Phones Computers P![[list:title ] Customized 1M 3A Fast Charging 4-in-1 Flat Metal Case USB Android Power Bank Type-C Connector Nylon](/runtime/image/mw200_mh_1754971132172086.jpg) Customized 1M 3A Fast Charging 4-in-1 Flat Metal Case USB Android Power Bank Type-C Connector Nylon

Customized 1M 3A Fast Charging 4-in-1 Flat Metal Case USB Android Power Bank Type-C Connector Nylon![[list:title ] 1m Aluminum Alloy Transparent Connector Type-C Data Fast Charging Cable 2-in-1 Nylon Jacket with Foi](/runtime/image/mw200_mh_1754971206813424.jpg) 1m Aluminum Alloy Transparent Connector Type-C Data Fast Charging Cable 2-in-1 Nylon Jacket with Foi

1m Aluminum Alloy Transparent Connector Type-C Data Fast Charging Cable 2-in-1 Nylon Jacket with Foi![[list:title ] USB 2.0 5-Pin SH Type Male Cable 1m Fast Charging 3A for Mobile Phones Power Banks Cameras Computers](/runtime/image/mw200_mh_1751290248528158.png) USB 2.0 5-Pin SH Type Male Cable 1m Fast Charging 3A for Mobile Phones Power Banks Cameras Computers

USB 2.0 5-Pin SH Type Male Cable 1m Fast Charging 3A for Mobile Phones Power Banks Cameras Computers![[list:title ] Universal PVC Insulated Copper Conductor Harness Wire Electronic Play Cable Plug for Gaming Machine](/runtime/image/mw200_mh_1751290043732325.png) Universal PVC Insulated Copper Conductor Harness Wire Electronic Play Cable Plug for Gaming Machine

Universal PVC Insulated Copper Conductor Harness Wire Electronic Play Cable Plug for Gaming Machine![[list:title ] Premium Custom PVC Insulated Auto Electrical Wiring Harness for Cars & Motorcycles Specific Appl](/runtime/image/mw200_mh_1751289911932558.png) Premium Custom PVC Insulated Auto Electrical Wiring Harness for Cars & Motorcycles Specific Appl

Premium Custom PVC Insulated Auto Electrical Wiring Harness for Cars & Motorcycles Specific Appl![[list:title ] OEM ODM Custom Motorcycle & Automobile PVC Insulated Electrical Wiring Harness Copper Custom Wir](/runtime/image/mw200_mh_1751289859503493.png) OEM ODM Custom Motorcycle & Automobile PVC Insulated Electrical Wiring Harness Copper Custom Wir

OEM ODM Custom Motorcycle & Automobile PVC Insulated Electrical Wiring Harness Copper Custom Wir![[list:title ] Manufacturer Customized PVC Insulated Copper Conductor Electrical Wire Harness for Electronic Applic](/runtime/image/mw200_mh_1751289819362910.png) Manufacturer Customized PVC Insulated Copper Conductor Electrical Wire Harness for Electronic Applic

Manufacturer Customized PVC Insulated Copper Conductor Electrical Wire Harness for Electronic Applic![[list:title ] Hot Sale 10PIN Female Flat Touch Screen Ribbon Cable RS232 Serial D-Sub DB9 9PIN Port IDC Male PVC C](/runtime/image/mw200_mh_1751289746509799.png) Hot Sale 10PIN Female Flat Touch Screen Ribbon Cable RS232 Serial D-Sub DB9 9PIN Port IDC Male PVC C

Hot Sale 10PIN Female Flat Touch Screen Ribbon Cable RS232 Serial D-Sub DB9 9PIN Port IDC Male PVC C![[list:title ] High Quality ZX330-5G Excavator Safety Relay 1825530391 24V Starter Essential Construction Machinery](/runtime/image/mw200_mh_1751289703107392.png) High Quality ZX330-5G Excavator Safety Relay 1825530391 24V Starter Essential Construction Machinery

High Quality ZX330-5G Excavator Safety Relay 1825530391 24V Starter Essential Construction Machinery![[list:title ] High Quality New Condition AUTO PARTS Wiring Harness 4HG1 NPR Cable Hand Brake Truck Wholesales PVC](/runtime/image/mw200_mh_1751289653205137.png) High Quality New Condition AUTO PARTS Wiring Harness 4HG1 NPR Cable Hand Brake Truck Wholesales PVC

High Quality New Condition AUTO PARTS Wiring Harness 4HG1 NPR Cable Hand Brake Truck Wholesales PVC![[list:title ] XHB High-Temperature Resistant Wiring Harness Locking Terminal Cable 200mm Length 12504H00-5P Connec](/runtime/image/mw200_mh_1751293406317163.png) XHB High-Temperature Resistant Wiring Harness Locking Terminal Cable 200mm Length 12504H00-5P Connec

XHB High-Temperature Resistant Wiring Harness Locking Terminal Cable 200mm Length 12504H00-5P Connec![[list:title ] XH2.54 JST Silicone Battery Wires Cable Connector 20cm Black Electronic Application 220mm Cable OC3](/runtime/image/mw200_mh_1751293362444100.png) XH2.54 JST Silicone Battery Wires Cable Connector 20cm Black Electronic Application 220mm Cable OC3

XH2.54 JST Silicone Battery Wires Cable Connector 20cm Black Electronic Application 220mm Cable OC3![[list:title ] XH2.54 JST 20cm Black Silicon Gel Wires Connector 380mm DC Ribbon Cable Wiring Harness for Electroni](/runtime/image/mw200_mh_1751293307595602.png) XH2.54 JST 20cm Black Silicon Gel Wires Connector 380mm DC Ribbon Cable Wiring Harness for Electroni

XH2.54 JST 20cm Black Silicon Gel Wires Connector 380mm DC Ribbon Cable Wiring Harness for Electroni![[list:title ] Wire Harness UL2468#24 White Blue 4P Ribbon Cable, One End HA-4P With Buckle, Other End HA-4P Withou](/runtime/image/mw200_mh_1751293254961173.png) Wire Harness UL2468#24 White Blue 4P Ribbon Cable, One End HA-4P With Buckle, Other End HA-4P Withou

Wire Harness UL2468#24 White Blue 4P Ribbon Cable, One End HA-4P With Buckle, Other End HA-4P Withou![[list:title ] UL-Certified Industrial Automation Servo Motor Cable 500mm Length Brown Blue PVC_PE Wires HA-6P SM-2](/runtime/image/mw200_mh_1751293224859016.png) UL-Certified Industrial Automation Servo Motor Cable 500mm Length Brown Blue PVC_PE Wires HA-6P SM-2

UL-Certified Industrial Automation Servo Motor Cable 500mm Length Brown Blue PVC_PE Wires HA-6P SM-2![[list:title ] PVC Plasticlogic Flexible Household Appliance Wiring Harness Tinned Copper Conductor One End Semi-St](/runtime/image/mw200_mh_1751293191631742.png) PVC Plasticlogic Flexible Household Appliance Wiring Harness Tinned Copper Conductor One End Semi-St

PVC Plasticlogic Flexible Household Appliance Wiring Harness Tinned Copper Conductor One End Semi-St![[list:title ] PVC Insulated Copper Conductor Wiring Harness Connector for Electric Cars for Automobile Use](/runtime/image/mw200_mh_1751293135247963.png) PVC Insulated Copper Conductor Wiring Harness Connector for Electric Cars for Automobile Use

PVC Insulated Copper Conductor Wiring Harness Connector for Electric Cars for Automobile Use![[list:title ] OEM UL2468 UL2651 Customized 5pin White Wiring Harness 1.27mm 2.0mm 2.54mm Electrical Wire JST XH Co](/runtime/image/mw200_mh_1751293103170614.png) OEM UL2468 UL2651 Customized 5pin White Wiring Harness 1.27mm 2.0mm 2.54mm Electrical Wire JST XH Co

OEM UL2468 UL2651 Customized 5pin White Wiring Harness 1.27mm 2.0mm 2.54mm Electrical Wire JST XH Co![[list:title ] Premium IP68 Waterproof Circular Connectors SP13 SP21 LED Cable Connector 2-7p Number Cores Wiring H](/runtime/image/mw200_mh_1751287652901338.png) Premium IP68 Waterproof Circular Connectors SP13 SP21 LED Cable Connector 2-7p Number Cores Wiring H

Premium IP68 Waterproof Circular Connectors SP13 SP21 LED Cable Connector 2-7p Number Cores Wiring H![[list:title ] Pole EV Battery Connector 8mm Copper Contact Material with 50A Rated Current Straight Orientation](/runtime/image/mw200_mh_1751287559833642.png) Pole EV Battery Connector 8mm Copper Contact Material with 50A Rated Current Straight Orientation

Pole EV Battery Connector 8mm Copper Contact Material with 50A Rated Current Straight Orientation![[list:title ] New Energy Inverter Battery Connectors 3P 120A Rated Copper Contacts EV Conversions with Straight An](/runtime/image/mw200_mh_1751287256545420.png) New Energy Inverter Battery Connectors 3P 120A Rated Copper Contacts EV Conversions with Straight An

New Energy Inverter Battery Connectors 3P 120A Rated Copper Contacts EV Conversions with Straight An![[list:title ] M12 Black Round Socket 2.5m Cable Waterproof 8-Pin Connector Enhanced IP67_IP68 Overmolded TPU Screw](/runtime/image/mw200_mh_1751287205474322.png) M12 Black Round Socket 2.5m Cable Waterproof 8-Pin Connector Enhanced IP67_IP68 Overmolded TPU Screw

M12 Black Round Socket 2.5m Cable Waterproof 8-Pin Connector Enhanced IP67_IP68 Overmolded TPU Screw![[list:title ] M12 3-Pin Connector Cable 1000mm Fast Electric Car Charging Station Single Output Indoor_Outdoor 8KG](/runtime/image/mw200_mh_1751287108943181.png) M12 3-Pin Connector Cable 1000mm Fast Electric Car Charging Station Single Output Indoor_Outdoor 8KG

M12 3-Pin Connector Cable 1000mm Fast Electric Car Charging Station Single Output Indoor_Outdoor 8KG![[list:title ] JL15EDGKNHM-35008B01 Black 2_8P Pitch 3.5mm 2 Row 8 Pin Terminal Blocks Position 2 for Wiring Harnes](/runtime/image/mw200_mh_1751287072360672.png) JL15EDGKNHM-35008B01 Black 2_8P Pitch 3.5mm 2 Row 8 Pin Terminal Blocks Position 2 for Wiring Harnes

JL15EDGKNHM-35008B01 Black 2_8P Pitch 3.5mm 2 Row 8 Pin Terminal Blocks Position 2 for Wiring Harnes![[list:title ] HVIL 2-Pin New Energy Vehicle Connector Socket 125A Capacity 25mm2 Cable Product Category Connectors](/runtime/image/mw200_mh_1751287006387917.png) HVIL 2-Pin New Energy Vehicle Connector Socket 125A Capacity 25mm2 Cable Product Category Connectors

HVIL 2-Pin New Energy Vehicle Connector Socket 125A Capacity 25mm2 Cable Product Category Connectors![[list:title ] High-Pressure PVC Insulated Wiring Harness for Automobiles Flexible Grease and Oil Hose H20PDU Coppe](/runtime/image/mw200_mh_1751286944271896.png) High-Pressure PVC Insulated Wiring Harness for Automobiles Flexible Grease and Oil Hose H20PDU Coppe

High-Pressure PVC Insulated Wiring Harness for Automobiles Flexible Grease and Oil Hose H20PDU Coppe